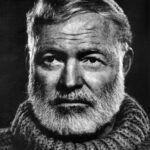

“How do you go bankrupt?" “Two ways. Gradually, then suddenly.”

Earnest Hemingway - The Sun Also Rises

Earnest Hemingway’s famous characters from The Sun Also Rises could well have been describing economic recession. The makings of a market correction build gradually, usually ignored by experts and business owners, fueled by the hubris and complacency that comes from years of market growth. Eventually, the wave crests. When it does, everything seems to come crashing down all at once.

Earnest Hemingway’s famous characters from The Sun Also Rises could well have been describing economic recession. The makings of a market correction build gradually, usually ignored by experts and business owners, fueled by the hubris and complacency that comes from years of market growth. Eventually, the wave crests. When it does, everything seems to come crashing down all at once.

Recession - a foregone conclusion...but how bad?

At the legendary annual meetup of the global elite in Davos, Switzerland, recession was accepted as almost inevitable. The only real question was, “how bad will it be?”

Some economists predict a mild recession, believing that inflation has peaked and that things may return to “normal” soon (meaning, the way things were 3-5 years ago, as if such good times have ever been normal). But those like me – with enough gray hair to remember the market turmoil in the 70s and 80s – recall how muddled recovery can get. Today, we are dealing with risk factors that didn’t exist 40 years ago. This is not just a “bump in the road”, it is a major turning point in our macro-economic cycle. The 40-year trend of declining interest rates has reached an end. We are in a new era.

Recession - the uninvited guest to the retirement party

For practitioners who thought they were nearing the end of their clinical career, this new reality is a major disruption and brings with it much uncertainty.

The most pressing problem is that, for the aging practitioner, time is not on your side. Whether haunted by back and neck pain, or simply just worn down by the headaches of managing staff, insurance and overhead, the reality of being forced to stay behind the chair due to lack of financial certainty is disheartening.

But recessions are not all bad. At least, not for everyone. Market volatility is a time of significant wealth transfer. There are winners as well as losers. There are opportunities for those who are willing to adapt and think differently from the majority.

What does it look like to pivot and adapt?

Capital Preservation is Key: Mitigate downside risk when possible

At a certain stage of life, the stakes become higher. As you age, you have less time to recover from a major setback. There are fewer years left in your career to waste rebuilding the nest egg you have already worked so hard to create.

Also, capital preservation is essential so that you not only avoid playing catch up, but also so that you have the resources available to take advantage of opportunities that the markets create. Wealth-creating opportunities materialize at the end of a recession – not the beginning.

Moving capital to “higher ground” investments that have less downside risk could be a smart move, reducing exposure to more market pullbacks. During periods of market contraction, capital preservation is the first step toward winning.

Pivot from the "accumulation" to the "Cash Flow" model

I was recently asked by a wealthy dentist, “When do you consider someone to be financially free? When they reach $5 Million? $10 Million?”

That question is based on the faulty assumptions of conventional financial advice. The premise is that “freedom” consists of accumulating a massive stockpile of money and hoping whatever you have managed to save is “enough” once you step away from active, earned income behind the dental chair. That model offers little certainty or peace of mind. How do you know when you have reached the magic number?

Instead, financial freedom is about living off of golden eggs without ever having to eat the golden goose. This means having enough recurring cash flow from your investments to sustain your family’s lifestyle on an ongoing basis, without the need to dip into or spend your principal.

Review your burn rate

The key to knowing “how much is enough” is in knowing your numbers and having a clearly defined target (what I call your “Freedom Number”), the amount of cash flow you need on a monthly basis to provide for your family without dependence on trading time for dollars.

Jeff Bezos recently faced the ire of the cancel mob for suggesting that people consider holding off on major purchases and save cash to prepare for a recession. There are many who might prefer to look to governments or institutions for solutions, vs taking personal responsibility for your own financial destiny.

His advice has particular relevance for high income earners. Recency bias runs rampant amongst practitioners who, after years of sacrifice and hard work, begin to believe that every year will inevitably be more profitable than the next. It is human nature to believe that income once experienced will last forever.

The lessons of the COVID virus and involuntary shutdowns are too soon forgotten. Reliance on earned income is a very vulnerable position. Next time, it may not be a global shutdown. One wrist injury, or the local municipality spending 3 years tearing up the road in front of your office, or a host of other circumstances outside your control, can significantly affect your ability to continue to scale your income.

It is a law of nature that, without careful vigilance, your burn rate will expand to match your income. Recession is a wakeup call to look for opportunities to eliminate waste and be strategic. Having “dry powder” on hand not only for unexpected needs but also to take advantage of opportunities is critical.

Go Back to Fundamentals

The last 10-12 year market rally has created hubris and dangerous optimism, as well as downright laziness for many investors. Massive amounts of money has flowed toward “moonshot” investments that have no semblance of real fundamentals (FTX and the litany of other Crypto scandals, for one example).

Even just the undue optimism of plugging money into a 401k and assuming that a financial advisor is going to make it magically grow, without bothering to understand the fundamentals driving those investments.

Investing for the long term should be focused on strong fundamentals.

Personally, I don’t know enough about the Wall Street markets to understand the fundamentals behind those investments. There are some who do (Warren Buffet is an expert at valuations of business assets), but to do that well requires massive effort well beyond the scope of most full time practitioners.

For me, real estate is a simple asset that I can easily evaluate based on specific fundamentals. If a property is cash flowing on a certain basis compared to my initial investment – the numbers make sense. No moonshots, no gambling on a future outside of my control.

Position for the next Great Wealth Transfer

Recession always creates significant wealth transfer. Wealth doesn’t disappear, it changes hands. I personally more than doubled my net worth coming out of the 2008 recession because I was in a position to take down deals on assets that were under-valued.

Asset valuations are like a pendulum. During a bull run market, the pendulum swings too high, assets become overvalued beyond any sensible calculation. When markets correct, the pendulum swings to the opposite side. There comes a time when assets become undervalued due to fear, or lack of available capital. That creates an opportunity to acquire assets on sale. To do that, you need to have liquidity, and you need to be positioned with the skill and access required to be in the game.

Find An Experienced Guide

One of the best things that I did when I was young, with more enthusiasm than smarts, was to connect with old timers who helped me avoid threats and find opportunities. Admittedly, in my younger years, I learned some lessons the hard way and have the scar tissue to prove it. But the older I get, the more valuable it becomes to me to avoid wasting time wandering paths alone when I can follow the trail of an experienced guide.

Unlike financial advisors who have a vested interest in maintaining your ignorance (their job security), the best guides in my life have been those who have accomplished what I wanted to accomplish, and who desired to show me the way.

To be clear, I don’t expect my guides to have a “perfect” track record. The best learning experiences are usually marked by scars. I want a guide who has integrity, who is willing to challenge the status quo, and one who has created the success in their life that I want to achieve.

From Suviving to Thriving

Yes, there are headwinds right now. Markets have shifted. The bull run party is over. These will likely impact your practice as well as your investing and retirement. But that doesn’t mean that hope is lost for practitioners who desire to create Freedom – the ability to enjoy more time outside the walls of their operatories – over the next few years.

Opportunities abound for those who are willing to pivot and adapt. Now is not a time for “analysis paralysis” or putting your head in the sand. For those who are willing to make strategic shifts, it is possible even in a recession to stay on track and shortcut major setbacks on the journey to Freedom.

Take action. Find a guide. Look for the opportunities this market cycle will create.