By Leo Townsend

OPERATIONS

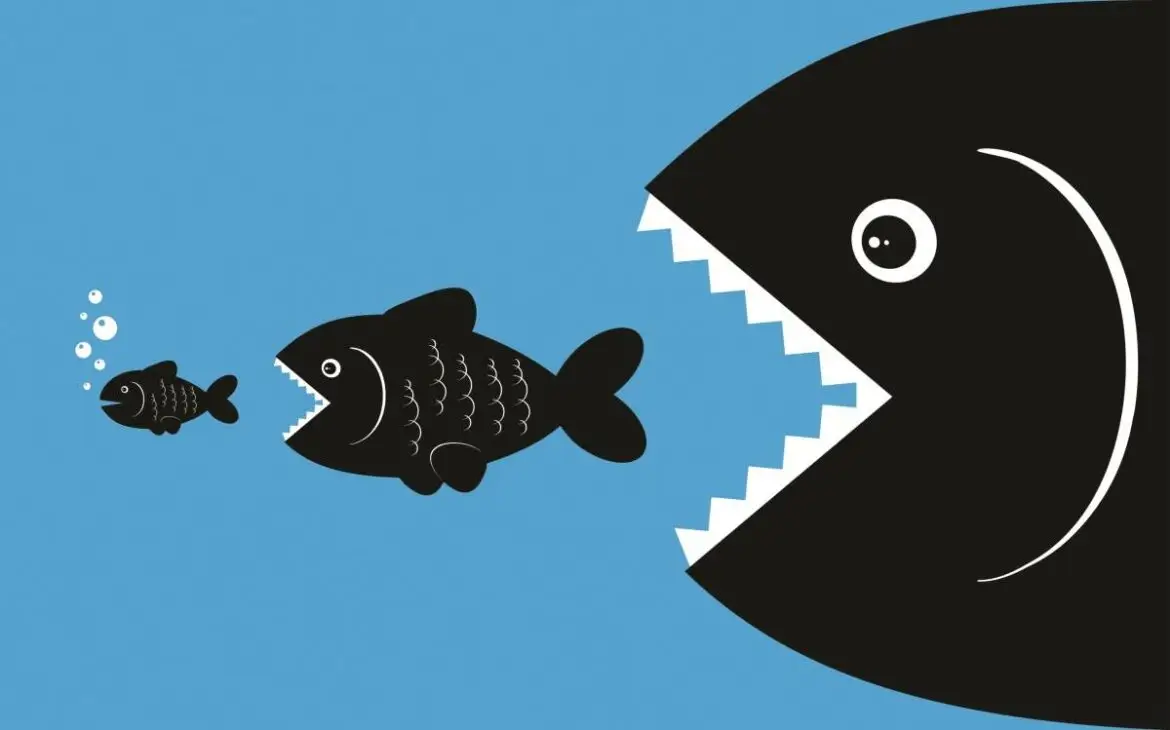

Over the last year or two, some of the largest credit card processing companies have merged and acquired each other. The biggest players in the US and Europe have consolidated their power and paid big money to acquire your account.

Many of the companies that handle dental management software were swept up in these series of acquisitions. I have found over the years that most people using dental management software to take credit cards have effective rates of 3-5% or more. This is why you’ve probably received more calls from your software company trying to get you to switch your processing for the convenience of use.

The profit margin on a dentist is already way above the norm for a variety of reasons. The companies that acquired the rights to integrate with your software are looking to recoup their investment as soon as possible, which means higher rates. We understand that your staff finds the software convenient, however, at what cost does that convenience become a burden to your budget and too expensive to continue to use for processing credit cards. Use it for your dental management needs. Don’t let them make you think it takes two minutes to key in a six-digit number when you do a credit card sale outside their system. It’s the same type of entry as if the patient paid by check.

If you look at your statement you’ll see that there is a new cast of players showing up as your processing company. This now allows you the opportunity to switch your processing bank. Most of these companies being acquired had contracts with renewals which would allow you to walk away at the end of your contract. You may have gotten calls trying to get you to sign new contracts with your “new” company.

They want to sign you to their new terms not be bound by the old ones. Don’t do it before having someone you trust look at your rates and the contract. The reason these companies acquired the merchant accounts is that the profitability on these accounts is high and they’re looking to take it higher.

We have been seeing merchant statements announcing HUGE April rate increases. These are some of the largest increases I’ve seen in my over 20 years in the industry.

We have been seeing merchant statements announcing HUGE April rate increases. These are some of the largest increases I’ve seen in my over 20 years in the industry. Statistics show that over 80% of merchants don’t look at their statements. When you factor in so many companies require you to go online to review your statements that number jumps to over 90%.

If you look at your March processing statement you’ll see these increases. This is the only notice that they need to give you. If you’re not paying attention, who knows what they’re doing to you! By processing after this notification, you have now agreed to these new rates. Most of these rate increases are larger than the standard interchange plus markup.

The reason these companies can impose such huge rate increases are termination fees, de-conversion fees, or whatever your company is calling the fee that they will charge you to leave their company. They’re trying to scare you and take advantage of you not knowing what to do. The secret is, if you don’t cancel the account and leave it open but dormant; you’ll probably get charged $40-50 a month to not process through that company.

If a legitimate company can offer you $300 a month in savings while you wait for the $3000 termination fee to expire, that’s a $250/month profit in your pocket while waiting. For example, we had a merchant who was told he had a $35,000 termination fee. We were able to save him $1400 a month. He left his previous account open but dormant for 2 ½ years and was charged $50 a month. This allowed him to switch his processing to us and save $1400 a month for a net profit of $1350 a month.